You fill your prescription for a generic drug-something you’ve taken for years-and the pharmacist says it’s $45 instead of your usual $5. You’re confused. It’s the same medicine, right? Same active ingredient. Same pill. Same doctor’s order. So why the huge jump?

It’s not about the drug. It’s about the contract.

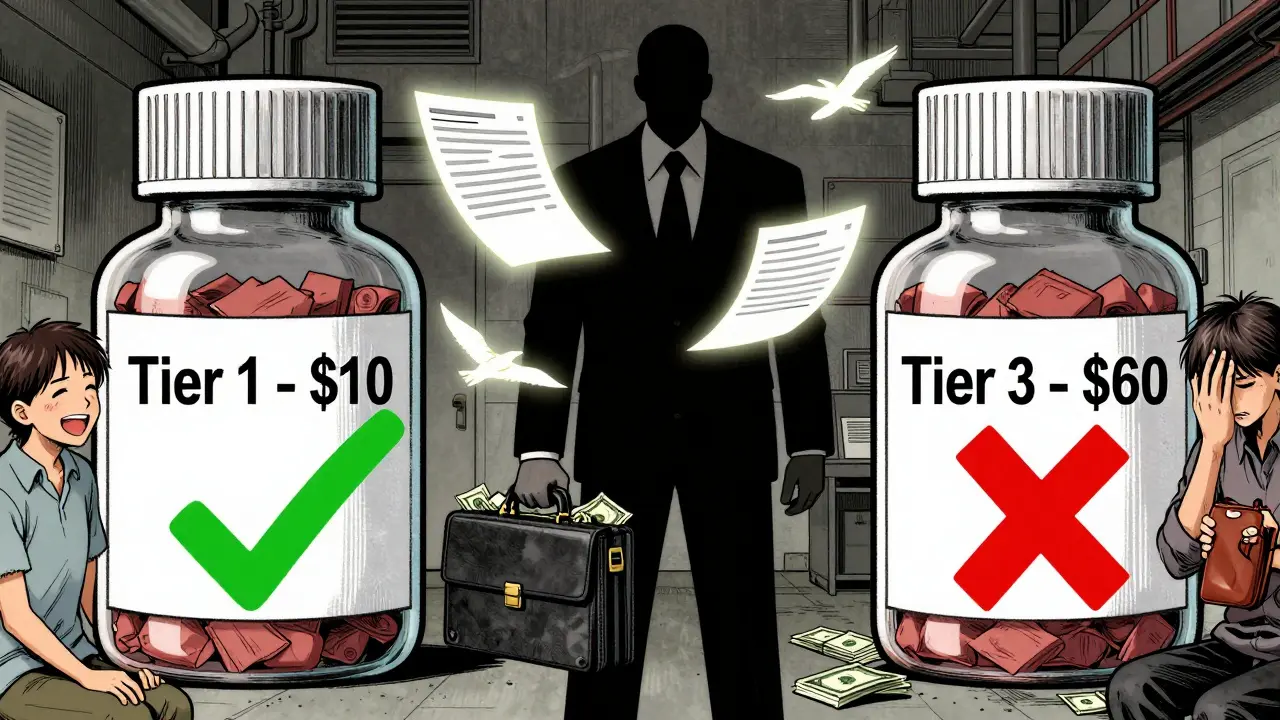

Most people assume that all generic drugs are treated the same by insurance. They’re not. Your plan uses something called a tiered formulary, a system that sorts medications into levels based on cost, not clinical value. Tier 1 is usually the cheapest-often $0 to $15 for a 30-day supply. That’s where most generics live. But not all of them. Some generics, even ones that are chemically identical to the Tier 1 version, end up in Tier 2 or even Tier 3. Why? Because the company that makes that particular generic didn’t pay enough of a rebate to the Pharmacy Benefit Manager (PBM). It’s not about safety. It’s not about effectiveness. It’s a business deal. PBMs like CVS Caremark, Express Scripts, and OptumRx negotiate discounts with drug manufacturers. The bigger the discount, the lower the tier. If a generic drug maker offers a better deal, their version gets placed in Tier 1. The others? They get bumped up. Even if they’re the exact same pill.How tiered copays actually work

Most plans have four or five tiers:- Tier 1: Preferred generics. Usually $0-$15.

- Tier 2: Preferred brand-name drugs. Around $25-$50.

- Tier 3: Non-preferred brand-name drugs. $60-$100.

- Tier 4: Preferred specialty drugs. 20-25% coinsurance.

- Tier 5: Non-preferred specialty drugs. 30-40% coinsurance.

Why your insurance doesn’t care if it’s the same pill

Imagine you have two brands of aspirin. One costs $2. The other costs $3. They’re both 325 mg, made by different companies. Your insurance picks the $2 one as preferred because the manufacturer gave them a bigger cut. The $3 version? Still fine. Still safe. Still effective. But now you pay more. That’s what’s happening with your prescription. Your plan doesn’t care which generic you take. They only care which one gave them the biggest discount. And if your doctor prescribed a version that doesn’t have that deal, you’re stuck paying the difference. This isn’t rare. In 2023, 41% of insured patients ran into a situation where a generic drug cost more than they expected. And 68% said their insurer gave them no clear reason why.

What you can do when your generic gets bumped

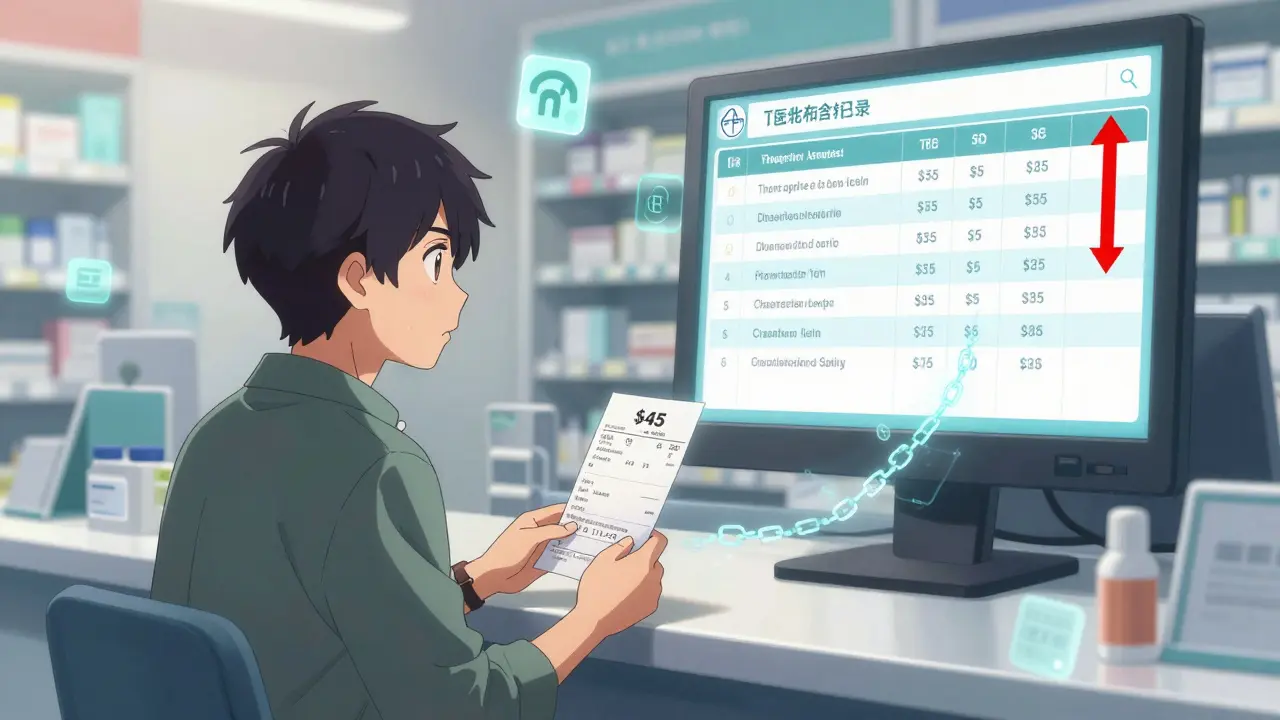

You’re not powerless. Here’s what works:- Check your formulary. Every plan updates it once a year, usually in October. Log into your insurer’s website and search for your drug. See what tier it’s on.

- Ask your pharmacist. They know which generics are preferred. If you get a different version, ask: “Is there another generic that’s cheaper?” Often, they can swap it without calling your doctor.

- Request a therapeutic interchange. This is a form your doctor can fill out asking the insurer to cover the non-preferred drug because it’s medically necessary. It works 63% of the time.

- Use GoodRx or SmithRx. These tools show you cash prices and which tier your drug is on. Sometimes, paying cash is cheaper than your copay.

- Appeal. If your drug was moved to a higher tier mid-year, you can file an exception. You have 72 hours for urgent cases. Write a note from your doctor explaining why switching hurts your health.

The bigger problem: specialty generics

Some of the worst surprises come with drugs for chronic conditions. Take adalimumab (Humira). The generic version came out in 2023. But instead of being a cheap Tier 1 drug, it’s in Tier 4 or 5. Why? Because it’s expensive to produce. Even though it’s a generic, you might pay 30% coinsurance on a $7,000 monthly dose. That’s $2,100 out of pocket. That’s not an outlier. In 2023, 12-18% of generics were classified as specialty drugs. Many patients with autoimmune diseases are shocked when their monthly bill jumps from $30 to $2,000 overnight. And they’re told, “It’s just a generic.”

Why the system won’t change soon

Tiered copays exist because they save insurers money. Studies show they reduce drug spending by 8-12%. That’s why 98% of employer plans and 99% of Medicare Part D plans use them. But the system is broken for patients. It rewards financial deals over clinical sense. And it creates confusion. A 2022 study found that when a drug moved from Tier 2 to Tier 3, adherence dropped by 7.3%. People stopped taking their meds because they couldn’t afford it-even though the drug hadn’t changed. The Inflation Reduction Act, starting in 2025, will cap out-of-pocket drug costs at $2,000 a year. That’s a win. But it won’t fix tiering. You’ll still pay more for the same drug just because your insurer didn’t get a good deal.What to remember

Your generic isn’t expensive because it’s bad. It’s expensive because the manufacturer didn’t pay enough to the middleman. And you’re the one who pays the difference. Next time your copay jumps, don’t assume it’s a mistake. Check your plan’s formulary. Talk to your pharmacist. Ask your doctor to help you switch to a preferred version. And don’t let silence from your insurer stop you from fighting back. The system isn’t designed to make sense. But you can still make it work for you.Why is my generic drug more expensive than the brand-name one?

It’s not common, but it happens. Some brand-name drugs are placed in lower tiers because the manufacturer pays a large rebate to the PBM. Meanwhile, a generic version with no rebate ends up in a higher tier. The brand may cost $100, but your copay is $50. The generic costs $20 to make, but your copay is $60 because no rebate was negotiated. The price you pay isn’t based on the drug’s cost-it’s based on the contract behind the scenes.

Can my insurer change my drug’s tier mid-year?

Yes. About 17% of commercial plans changed their formularies between January and June 2023. Insurers can move drugs to higher tiers if the rebate deal expires or if a competitor offers a better one. You’ll usually get a notice in the mail, but many people miss it. Always check your formulary before refilling, especially if you’re on a chronic medication.

Are all generics the same?

In terms of active ingredients, yes. The FDA requires generics to be bioequivalent to the brand. But inactive ingredients (fillers, dyes, coatings) can vary. For most people, this doesn’t matter. But for a small number of patients-like those with severe allergies or absorption issues-switching generics can cause problems. That’s why your doctor should be consulted before any substitution.

What’s the difference between a preferred and non-preferred generic?

There’s no clinical difference. The terms “preferred” and “non-preferred” are purely financial. Preferred means the manufacturer gave the PBM a big discount. Non-preferred means they didn’t. Your plan encourages you to pick the preferred version by making it cheaper. But both versions work the same way.

Can I get help paying for a high-tier generic?

Yes. Many drug manufacturers offer patient assistance programs that cover part or all of the cost for eligible people. You can also use nonprofit organizations like the Patient Advocate Foundation or NeedyMeds. Some pharmacies offer discount cards through GoodRx that can slash your price below your copay. Always ask your pharmacist-many don’t bring it up unless you ask.

Laia Freeman January 29, 2026

This is insane!! I just got charged $60 for my generic lisinopril-same pill I’ve taken for 5 years!! My pharmacist said it’s ‘non-preferred’ now?? Like, what does that even mean?? I didn’t change anything!! Why am I paying more for the SAME THING?? This system is rigged!!

rajaneesh s rajan January 29, 2026

So let me get this straight: the pill doesn’t change, the doctor doesn’t change, but your wallet gets lighter because some suit in a cubicle got a better kickback? Welcome to capitalism, baby. At least we still have GoodRx. And also, the fact that we’re all here screaming into the void together? That’s the only real therapy left.

paul walker January 30, 2026

I had this happen with my diabetes med last month. I called my doc, asked for a therapeutic interchange, and they approved it in 2 days. Took me 10 minutes on the phone. Don’t let them scare you-ask. Always ask. Seriously. It works more than you think.