By 2025, if you’re on Medicare and take generic medications, your out-of-pocket costs could drop by hundreds of dollars a year - and in some cases, drop to $0. That’s not a guess. It’s the reality of the new Medicare Part D rules that took effect this year. The changes, brought by the Inflation Reduction Act, were designed to fix a broken system where seniors paid thousands just to fill basic prescriptions. Now, the system is built to reward generic drugs - the cheapest, most effective option for most people.

What changed in Medicare Part D for generics in 2025?

The biggest shift? The out-of-pocket spending cap for prescription drugs dropped from nearly $8,000 to just $2,000. That means once you’ve paid $2,000 in eligible costs for your meds in a year, you pay nothing for the rest of the year - no matter how many prescriptions you fill. This applies to both brand-name and generic drugs, but since generics make up 84% of all Part D prescriptions, most people hit that cap faster.

Before 2025, you’d pay 25% coinsurance on generics after your deductible, then get stuck in a coverage gap (the donut hole) where you paid 25% of the full price. Now, you still pay 25% during the initial phase, but you’re protected from the old gap. Once you hit $2,000, you’re in catastrophic coverage - and that’s where the real savings kick in. You pay $0 for your generics after that point. For someone taking three or four daily generics, that can mean $1,000+ in annual savings.

How much do generics actually cost under Part D?

On average, a 30-day supply of a preferred generic drug costs $10 or less in 2025, whether you’re in a stand-alone Part D plan or a Medicare Advantage plan with drug coverage. That’s the median. Many plans charge as little as $4 or $5 for common meds like lisinopril, metformin, or atorvastatin.

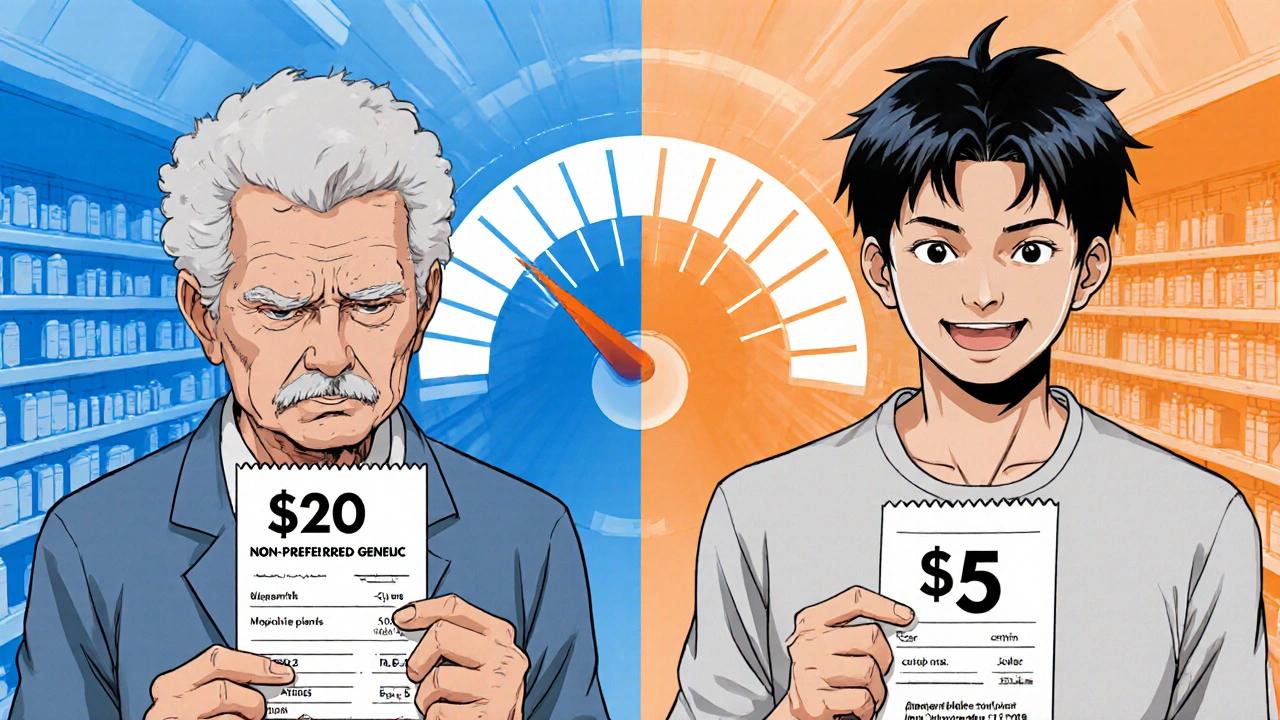

But here’s the catch: not all plans treat all generics the same. Plans have tiers. Preferred generics are the cheapest. Non-preferred generics might cost $20 or more. And some plans still require prior authorization or step therapy - meaning you have to try a cheaper generic first before they’ll cover another one, even if your doctor says it’s better for you.

For example, if you take a generic blood pressure med that’s on your plan’s preferred list, you pay $5. If your doctor switches you to a different generic in the same class that’s not preferred, your copay jumps to $18. That’s not a mistake - it’s how plans control costs. The key is checking your plan’s formulary before you enroll.

PDP vs. MA-PD: Which saves more on generics?

If you’re choosing between a stand-alone Part D Prescription Drug Plan (PDP) and a Medicare Advantage Plan with drug coverage (MA-PD), the answer isn’t obvious. The copays for generics are nearly identical - around $10 on average. But the monthly premiums are wildly different.

On average, PDPs cost $39 a month. MA-PDs? Just $7. That’s more than five times the difference. So even if you pay the same $10 copay for your meds, you’re saving $384 a year just on premiums by choosing an MA-PD. Combine that with the $2,000 out-of-pocket cap, and the total savings become clear.

But there’s a trade-off. MA-PDs often have narrower networks. If you see specialists or live in a rural area, you might have fewer options. PDPs are more flexible - you can use any pharmacy that accepts Medicare. So if you travel often or have specific pharmacy needs, a PDP might be worth the higher premium.

Who saves the most?

The people who save the most are those taking multiple generics daily - especially seniors with chronic conditions like diabetes, high blood pressure, or high cholesterol. Someone taking five generic meds a day, each costing $10, would pay $150 a month. That’s $1,800 a year. They hit the $2,000 cap by October, then pay $0 for the rest of the year. That’s a $1,800+ saving compared to last year.

Low-income beneficiaries get even more help. If you qualify for Extra Help (Low-Income Subsidy), you pay $0 for your deductible and only $0 to $4.50 for each generic prescription - no matter what tier it’s on. You also skip the coverage gap entirely. About 12 million people get this help, and for them, generic drugs are almost free.

Why some people still struggle

Not everyone’s experience is smooth. A 2024 survey found that 41% of Medicare beneficiaries didn’t understand how manufacturer discounts counted toward their $2,000 cap. If your drugmaker gives you a coupon or rebate, that money counts toward your out-of-pocket total - but many people don’t realize it. That can lead to confusion when their bills don’t drop as expected.

Another issue: therapeutic substitution. Some plans automatically swap your generic for another one - even if your doctor prescribed a specific brand. You might end up with a different pill that works fine, but costs more in copay. That’s legal, but it’s frustrating. The Medicare Rights Center reported a 23% spike in calls about this in 2024.

And while the system is better, it’s not perfect. Some plans still limit access to generics with prior authorization. One 2024 report found that Part D plans used stricter rules for generics than commercial insurers. That means you might need extra paperwork just to get a $5 pill.

How to make sure you’re getting the best deal

Use the Medicare Plan Finder tool. It’s updated every October, and it lets you type in your exact medications - including the generic names - and compare plans side by side. Look for:

- Which tier your meds are on (preferred = cheaper)

- Whether there’s a deductible (some plans still have one up to $590)

- If your pharmacy is in-network (some plans have preferred pharmacies with lower copays)

- Any step therapy or prior auth requirements

Don’t just pick the cheapest premium. Pick the plan that costs the least for your actual meds. A $30 plan with $15 copays might cost you more than a $45 plan with $5 copays if you take five generics a month.

Also, check if your drugmaker offers a savings card. Many generic manufacturers now give out coupons that reduce your out-of-pocket cost - and those savings count toward your $2,000 cap. That’s a hidden perk most people miss.

What’s coming next

The government is already looking ahead. Starting in 2026, a new program will give Part D plans a 10% subsidy to cover the cost of high-priced generics - the kind that aren’t quite as cheap as aspirin but still beat brand names. That could push copays even lower.

Biosimilars - generic versions of complex biologic drugs - are also gaining ground. In 2025, they’re still rare in Part D, but by 2028, they could make up 35% of the biologic market. That means more savings on drugs for conditions like arthritis and cancer.

For now, the message is simple: if you take generics, you’re benefiting from the biggest change to Medicare drug coverage in 20 years. The system still has flaws, but the financial relief is real. You don’t need to be an expert to save - just informed.

Do generic drugs cost less under Medicare Part D in 2025?

Yes. In 2025, the average copay for a preferred generic drug is $10 or less for a 30-day supply. Many plans charge as little as $4 or $5. Once you hit the $2,000 out-of-pocket cap, you pay $0 for all generics for the rest of the year.

Does the $2,000 out-of-pocket cap include my monthly premium?

No. Only what you pay for your drugs - deductibles, copays, and coinsurance - counts toward the $2,000 cap. Your monthly premium does not count, no matter which plan you choose.

Can I switch my Part D plan anytime to get better generic coverage?

You can only switch during the Annual Enrollment Period (October 15 to December 7). But if you qualify for Extra Help or move out of your plan’s service area, you can switch at other times. Always check your plan’s rules before making a change.

Why does my generic drug cost more this year even though it’s the same medicine?

Your plan may have changed the tier your drug is on. Even if the pill is the same, if it’s moved from preferred to non-preferred, your copay can jump from $5 to $20. Always check your plan’s formulary each year - it changes frequently.

Do manufacturer discounts count toward my $2,000 cap?

Yes. If your drugmaker gives you a coupon or rebate that lowers your price at the pharmacy, that amount counts toward your out-of-pocket spending. This is a key way many people reach the $2,000 cap faster.

How do I know if I qualify for Extra Help?

If your income is below $21,870 for an individual or $29,580 for a couple in 2025, and your resources are under $17,220 (or $34,360 for a couple), you likely qualify. You can apply through Social Security or your state Medicaid office. Extra Help can cut your generic copays to $0-$4.50 and eliminate your deductible.

Ragini Sharma November 22, 2025

so like... i just found out my $5 lisinopril counts toward the $2k cap?? and i’ve been using manufacturer coupons for years?? lmao i feel like a genius and an idiot at the same time. also why does my plan call it 'preferred' when it’s literally the only one they carry??

Henrik Stacke November 24, 2025

One must acknowledge the profound structural reform embedded within the 2025 Part D revisions. The cap on out-of-pocket expenditure constitutes a watershed moment in the democratization of pharmaceutical access. In the United Kingdom, where such subsidies remain fragmented, this model merits serious policy consideration. A truly commendable evolution in public health infrastructure.

Olanrewaju Jeph November 25, 2025

This is huge for people in Nigeria who have family on Medicare. My aunt in Chicago was paying $300/month for her meds last year. Now she pays $5 and stops after October. She’s sending money home to help with her sister’s diabetes meds. This policy change is saving lives across borders.

Dalton Adams November 26, 2025

Look, if you’re still confused about tiered generics, you probably shouldn’t be managing your own meds. I’ve been doing this since 2018. The Plan Finder tool is literally a 3-click process. If you can’t figure out that 'preferred' = cheaper, maybe ask your grandkid. Also, stop using coupons - they’re just pharma’s way of keeping you hooked. 😒

Kane Ren November 28, 2025

This is honestly one of the most hopeful things I’ve seen in healthcare in my lifetime. I used to skip my metformin because it was $45. Now? I take it like candy. My A1C dropped from 8.2 to 6.1. I’m not just surviving - I’m thriving. Thank you, Inflation Reduction Act. 🙌

Charmaine Barcelon November 29, 2025

Ugh. I knew this was coming. People are going to think they’re 'saving money'... but they’re just being manipulated by insurance companies. They’ll raise premiums next year. And what about the 20% of generics that aren’t covered? You think this is a win? It’s a trap. A very shiny, very dangerous trap.

Karla Morales November 30, 2025

Let’s be real - this is just PR. The real winners are the PBMs and the drug manufacturers who now get to charge more for 'non-preferred' generics while pocketing the difference. 💸 And don’t get me started on how they game the coupon system. This isn’t relief - it’s a well-lit maze.

Javier Rain November 30, 2025

Stop overthinking it. If you’re on 3+ generics, you’re already saving hundreds. Go to the Plan Finder. Type in your pills. Pick the one with the lowest total cost. Done. No drama. No guilt. Just take your meds and live your life. You’ve earned this.

Laurie Sala December 2, 2025

I’ve been crying all day… I didn’t realize I was going to pay $0 after October… I’ve been hoarding my pills because I couldn’t afford them… I’m not even mad anymore… just… grateful…

Lisa Detanna December 4, 2025

My mom switched from PDP to MA-PD last year and saved $400 on premiums alone. She’s got a narrow network, but her local CVS is in, and her pharmacy tech helped her print out the formulary. Sometimes the system works - if you’re willing to put in the 20 minutes to check it.

Demi-Louise Brown December 6, 2025

The data is clear. The $2,000 cap has significantly reduced medication non-adherence among low-income seniors. The reduction in emergency visits for uncontrolled hypertension and diabetes has been documented in CMS reports. This policy is achieving its intended outcome.

Matthew Mahar December 7, 2025

wait so if i use a coupon does that count?? i thought they were just for people who dont have medicaire?? i just got a $10 off coupon for my atorvastatin and now im confused??

John Mackaill December 8, 2025

That’s exactly right - manufacturer discounts count toward the cap. I’ve been advising seniors in Glasgow for years: always ask the pharmacist to apply any coupons. It’s not just a perk - it’s a lifeline. Thank you for bringing this up. It’s the little details that make the biggest difference.