When your prescription switches from a brand-name drug to a generic, you expect lower costs. But what if the generic isn’t the usual kind? What if it’s authorized generic-the exact same pill, same manufacturer, same ingredients, just without the brand name? Many people don’t realize this option exists, and even fewer understand how insurance handles it. The truth is, authorized generics sit in a strange middle ground: they’re not brand, they’re not traditional generics, but they’re often the best deal you can get.

What Exactly Is an Authorized Generic?

An authorized generic is the brand-name drug you know, made by the same company, but sold under a different label. It’s not a copy. It’s the real thing-same active ingredients, same inactive ingredients, same factory, same quality control. The only difference? No brand name on the bottle. You might see it as a white pill with a code instead of a colorful tablet with a logo. The FDA defines it clearly: it’s a drug approved under the original New Drug Application (NDA), not through the Abbreviated New Drug Application (ANDA) used by regular generics. That means no bioequivalence testing is needed. It’s already proven. This is why authorized generics hit the market faster than traditional generics-sometimes even before them. Examples? Protonix, Ocella, Yasmin. These are all brand-name drugs with authorized generic versions available. If you’ve ever been prescribed one of these and got a cheaper version that looked identical, you might’ve gotten an authorized generic without even knowing it.Why Insurance Companies Care About Authorized Generics

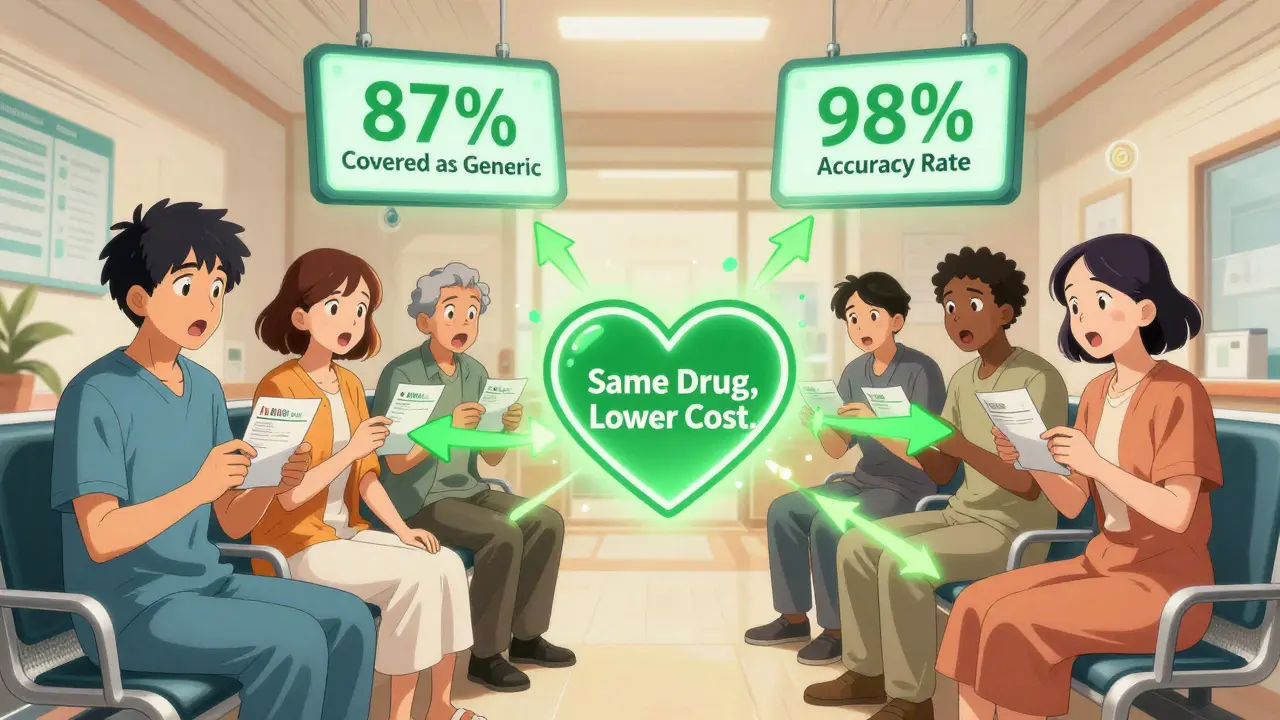

For insurers, authorized generics are a win-win. They offer the same effectiveness as the brand-name drug but at generic prices. That means lower costs for the plan-and lower copays for you. Most commercial insurance plans put authorized generics in Tier 2, the same as traditional generics. That’s a big deal. Brand-name drugs usually land in Tier 3 or 4, with much higher out-of-pocket costs. A 2022 study of 1,247 Medicare Part D plans found that 87% of them treated authorized generics the same as regular generics. Only 12% put them in the higher-cost brand tiers. That’s because insurers know: if the drug is identical, why charge more? The savings add up. Plans that actively cover authorized generics saw 7.3% lower per-member-per-month drug costs compared to those that didn’t. That’s not just a few dollars-it’s millions across a large plan.How Authorized Generics Differ from Traditional Generics

Here’s where things get tricky. Traditional generics are made by different companies. They must prove they work the same as the brand through bioequivalence studies. Authorized generics? They’re made by the brand company itself. No testing required. Same formula. Same batch. This matters for patients with allergies or sensitivities. Some people react to specific fillers or dyes in generics. With an authorized generic, you’re getting the exact same inactive ingredients as the brand. No surprises. But here’s the catch: authorized generics aren’t available for most drugs. Only about 15-20% of brand-name medications have them. That means for many prescriptions, you still have to choose between the expensive brand or a traditional generic that might not be identical.

How Formulary Placement Works in Practice

Your insurance plan’s formulary is a list of covered drugs, grouped into tiers. Tier 1 is cheapest, Tier 4 is most expensive. Authorized generics almost always land in Tier 2. But getting them covered isn’t automatic. Pharmacy benefit managers (PBMs) like Express Scripts, OptumRx, and CVS Caremark have to update their systems to recognize the unique National Drug Code (NDC) for each authorized generic. This isn’t always easy. Authorized generics don’t show up in the FDA’s Orange Book, which is where most pharmacy systems look for generic info. So if the system doesn’t know it’s an authorized generic, it might treat it as a brand-name drug-and deny coverage or charge you more. That’s why some pharmacies had a 12% error rate when first processing these claims. Walgreens, for example, had to build special verification tools to fix the issue. Now, most major PBMs use proprietary databases like Prime Therapeutics’ AG Tracker to identify authorized generics accurately. These tools cover 98% of available products.What Patients Experience

Patients often don’t know they’re getting an authorized generic. The label looks different. The pill might be a different color. If you’re used to your brand-name drug, this can cause confusion-or anxiety. One Reddit user, u/MedicationWarrior, shared how their insurance denied Synthroid (a brand-name thyroid drug) but approved the authorized generic with a $10 copay instead of $50. They’d been on the brand for years due to sensitivity to fillers in other generics. The authorized version was the only option that worked. But not everyone has that luck. A 2022 GoodRx survey found 34% of patients were confused when their pharmacy switched them to an authorized generic without warning. 18% got denied coverage at first because the system didn’t recognize the NDC code. It took calls to the insurer to fix it. The good news? 89% of authorized generic claims are approved on the first try. That’s better than brand-name drugs (76%) and close to traditional generics (92%).Who Makes Authorized Generics?

Most authorized generics are produced by just a few companies. Greenstone (a Pfizer subsidiary), Prasco, and Patriot Pharmaceuticals make up 63% of the market. These companies have direct deals with brand manufacturers to produce and sell the same drug under a different label. This arrangement benefits the brand company. They keep market share after the patent expires. Instead of losing everything to competitors, they capture part of the generic market themselves. Critics say this slows down true generic competition. A 2021 study found that in 22% of cases, the introduction of an authorized generic delayed the entry of independent generic manufacturers. But for patients and insurers? It’s still cheaper than the brand.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act of 2022 is pushing more authorized generics into Medicare Part D. By 2025, CMS expects coverage to rise 15-20% as part of efforts to cut out-of-pocket costs. Major PBMs are already adapting. OptumRx launched an “Authorized Generic First” policy for 47 high-cost drugs in early 2023. Express Scripts added special flags to their formulary system in late 2022 to flag these drugs automatically. Employers are taking notice too. According to the Kaiser Family Foundation’s 2023 survey, 68% of large employers plan to treat authorized generics differently from traditional generics in 2024 plans. Some may even offer lower copays for authorized generics to encourage use. The FDA is helping too. Their 2023 GDUFA III rules include better tracking and reporting of authorized generics. That means clearer data, fewer system errors, and more reliable coverage.What You Should Do

If you’re on a brand-name drug that’s expensive:- Ask your pharmacist: “Is there an authorized generic for this?”

- Check the FDA’s list of authorized generics (updated monthly).

- If your insurance denies coverage, call them. Ask why. Mention that it’s the same drug as the brand and should be covered as a generic.

- If your pharmacy switches you without warning, ask for the new NDC code. Verify it’s an authorized generic.

Elizabeth Cannon January 22, 2026

so i got switched to an authorized generic for my blood pressure med and at first i was like wtf is this white pill?? but then i checked the bottle and it was the exact same maker as my brand. no more $80 copay, now it’s $12. insurance didnt even flinch. why dont more people know this??

Izzy Hadala January 22, 2026

It is imperative to note that authorized generics, by virtue of their derivation from the original New Drug Application, are pharmacologically indistinguishable from their branded counterparts. The regulatory framework governing their approval precludes the need for bioequivalence studies, thereby ensuring therapeutic equivalence without the latency associated with ANDA submissions. This distinction is critical for formulary decision-making and should be explicitly delineated in payer policies.

Gina Beard January 23, 2026

Same pill. Different label. That’s all it is. We overcomplicate everything.