When you’re fighting cancer, the last thing you should worry about is how to pay for treatment. But for too many people, that’s exactly what happens. Financial toxicity isn’t just a buzzword-it’s a real, daily struggle that affects whether someone takes their medicine, keeps their home, or even survives. It’s the moment you have to choose between filling your prescription and paying your rent. It’s the sleepless nights after seeing the bill for your immunotherapy infusion. And it’s not rare. Nearly half of all cancer survivors face it.

What Financial Toxicity Really Means

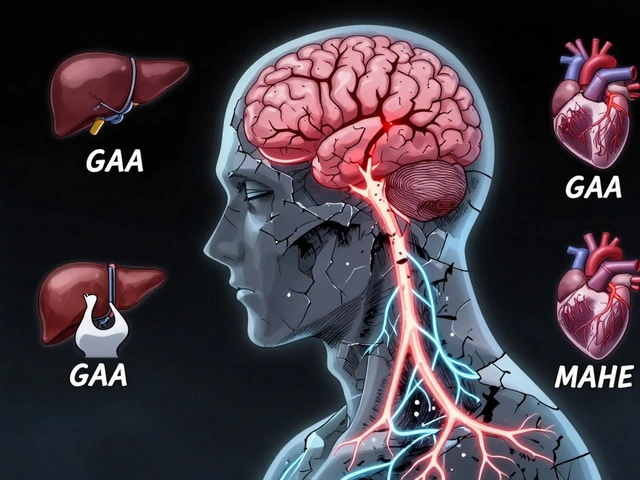

Financial toxicity isn’t just about being broke. It’s the emotional, physical, and practical fallout from the cost of cancer care. The term was first used by researchers at Duke University in 2013, and since then, the National Cancer Institute (NCI) has officially defined it as "problems a patient has related to the cost of medical care." That includes everything: copays, deductibles, travel to appointments, time off work, childcare during treatment, and even the cost of wigs or special foods. It’s not just the price tag on a drug. It’s the hidden costs that pile up. A 2021 study found that 13% of non-elderly cancer patients spend at least 20% of their entire annual income just on out-of-pocket medical costs. For low-income women with breast cancer, that number jumps to 98%. That’s not a mistake. That’s the reality for thousands. And it’s getting worse. Newer treatments-like targeted therapies and immunotherapies-are lifesaving, but they can cost $10,000 to $20,000 a month. Some patients stay on them for years. One study showed that 82% of patients in early-stage clinical trials reported serious concerns about medical bills. These aren’t fringe cases. These are people just like you.Who’s Most at Risk

Not everyone experiences financial toxicity the same way. Some groups are hit much harder.- Younger patients (under 65): They’re more likely to be working, have kids, and have less savings. Many are underinsured, stuck with high-deductible plans that leave them paying thousands before insurance kicks in.

- People with metastatic cancer: Their treatment doesn’t end after six months. It lasts for years. Every scan, every drug refill, every hospital visit adds up.

- Low-income communities: When your annual income is $30,000 and your cancer drug costs $15,000, you’re not choosing between luxury and necessity-you’re choosing between survival and ruin.

- Underinsured patients: Even if you have insurance, it might not cover oral drugs the same way it covers IV treatments. That’s a huge problem-many newer cancer drugs are pills you take at home, and those often come with higher copays.

How Financial Toxicity Affects Your Health

People assume that if you’re getting treatment, you’re getting better. But financial stress can undo everything. Patients who are financially strained report:- Higher levels of pain and fatigue

- More anxiety and depression

- Worse sleep and appetite

- Less social interaction

- Greater fear of cancer coming back

What You Can Do Right Now

You don’t have to face this alone. There are real, working solutions.1. Ask for Financial Navigation Help

Many cancer centers now have financial navigators-specialists who help patients find help with bills, insurance, and assistance programs. These aren’t just advisors. They’re advocates. They know which drug manufacturers offer free medication, which nonprofits give grants, and how to appeal insurance denials. A 2022 study showed that when patients worked with a financial navigator, treatment abandonment due to cost dropped by 30-50%. That’s life-changing. If your hospital doesn’t have one, ask. Demand one. They’re becoming standard at major cancer centers.2. Use Co-Pay Relief Programs

Organizations like the Patient Advocate Foundation and the CancerCare Co-Pay Assistance Foundation give direct financial help to cancer patients. In 2022 alone, the Patient Advocate Foundation gave out $327 million to 67,000 people. You don’t need to be poor to qualify. Many programs help people with insurance who still can’t afford their copays. Check out their websites-applications are simple and confidential.3. Get Help from Drug Manufacturers

Almost every major cancer drug maker has a patient assistance program. These can give you free drugs if you meet income guidelines. In 2021, pharmaceutical companies provided $12.8 billion in support to 1.8 million patients. You don’t need to know how to apply. Ask your oncologist or pharmacist. They often have the forms and can help you fill them out.4. Check State and Federal Programs

Some states have passed laws to help. California’s 2022 Cancer Drug Affordability Act requires drug makers to disclose pricing and justifies high costs. Other states are following. Medicare beneficiaries can apply for Extra Help (Low-Income Subsidy) to lower prescription costs. Medicaid may cover more than you think-especially if your income drops during treatment.5. Ask About Generic or Alternative Drugs

Not every new, expensive drug is the only option. Sometimes, older, cheaper drugs work just as well. Talk to your oncologist about alternatives. Ask: "Is there a generic version? Is there another drug with similar results that costs less?"What’s Changing-And What’s Coming

The system is slowly waking up. The American Society of Clinical Oncology (ASCO) now requires financial toxicity screening as part of its Value Framework. That means oncologists are being trained to ask patients about money-just like they ask about pain or fatigue. The National Comprehensive Cancer Network (NCCN) updated its 2023 guidelines to include financial assessment in survivorship care. That’s huge. It means financial health is now part of cancer recovery. AI is even being used to predict who’s at risk. A 2023 study showed an algorithm could spot patients likely to face financial hardship with 82% accuracy by looking at their income, insurance, and treatment plan. That means help can come before the crisis hits. Legislation like the Cancer Drug Parity Act (H.R. 4553) aims to make oral drugs cost the same as IV drugs. Right now, you might pay $500 for an IV infusion covered by insurance, but $2,000 for the same drug in pill form. That’s not fair. That’s changing. The American Cancer Society has pledged $15 million over the next two years to fund financial toxicity programs. That’s a signal: this is no longer a side issue. It’s central to cancer care.

What to Do If You’re Already Overwhelmed

If you’re already drowning in bills:- Don’t ignore the mail. Open every bill. Some are errors.

- Call the billing department. Ask for a payment plan. Most hospitals will work with you.

- Don’t feel guilty. You didn’t cause this. The system did.

- Reach out to local nonprofits. Food banks, transportation services, and even utility assistance programs often help cancer patients.

- Consider talking to a nonprofit credit counselor. They can help you manage debt without bankruptcy.

Final Thought: You Deserve Care Without Ruin

Cancer is hard enough. You shouldn’t have to choose between your health and your home. Financial toxicity is not your fault. It’s a broken system. But you can fight it-with the right tools, the right people, and the right information. Start today. Ask your care team: "Do you have a financial navigator?" Call one assistance program. Fill out one form. You’re not asking for charity. You’re asking for what you’re entitled to. Your life is worth more than a bill.What is financial toxicity in cancer care?

Financial toxicity is the severe financial burden and emotional distress caused by the cost of cancer treatment. It includes out-of-pocket expenses like copays, medications, travel, and lost income, as well as the stress of choosing between paying for care and covering basic needs like food or rent. The term was coined in 2013 and is now recognized by the National Cancer Institute as a serious consequence of cancer care.

How common is financial toxicity among cancer patients?

It’s extremely common. Studies show that 28-48% of cancer survivors experience measurable financial toxicity, and up to 73% report feeling financial stress. In some groups-like low-income women with breast cancer-treatment costs can consume nearly all of their annual income. One in eight non-elderly patients spends at least 20% of their income on cancer care.

Can financial toxicity affect my cancer treatment outcomes?

Yes. Patients who struggle to pay for treatment are more likely to skip doses, delay appointments, or stop treatment entirely. Research shows this leads to worse survival rates, more symptoms, and lower quality of life. Financial stress can be as damaging as the cancer itself.

What programs can help me pay for cancer treatment?

Many options exist: pharmaceutical patient assistance programs (offering free drugs), the Patient Advocate Foundation’s Co-Pay Relief Program, state-level affordability laws, Medicaid expansion, Medicare Extra Help, and nonprofit grants. Cancer centers with financial navigators can help you apply. In 2022, these programs provided over $300 million in direct aid to cancer patients.

Should I talk to my oncologist about money problems?

Absolutely. Oncologists are now trained to ask about financial stress. If you’re struggling to pay for treatment, tell them. They can help you find lower-cost alternatives, connect you with financial navigators, or adjust your treatment plan. Your health depends on it-and so does your survival.

Are there laws to protect cancer patients from high drug costs?

Yes. California’s 2022 Cancer Drug Affordability Act requires drug makers to justify price hikes. The proposed Cancer Drug Parity Act would make oral cancer drugs cost the same as IV ones. Many states are now exploring similar laws. At the federal level, the NCCN and ASCO now treat financial toxicity as a standard part of cancer care, pushing for systemic change.

Shayne Smith December 6, 2025

Just had my mom go through this last year. I didn’t even know half of these programs existed until we were drowning in bills. Financial navigators are LEGENDS. My hospital had one who got us $18k in free meds and a payment plan that didn’t crush us. Seriously, if you’re reading this and you’re stressed - reach out. You’re not alone.

Also, wigs are expensive. Like, $800 expensive. Turns out some nonprofits give them for free. Who knew?

Nigel ntini December 7, 2025

This is one of the most important posts I’ve read all year. Not just because it’s factual - but because it’s human. Too many people treat cancer like a medical puzzle to solve, not a life to protect. The fact that we let people choose between rent and chemo is a moral failure. We need systemic change, but until then - use these resources. They’re real. They work.

And if you’re a provider? Start asking about money. Like, right now. It’s not awkward. It’s essential.

Kumar Shubhranshu December 7, 2025

Drug companies are ripping us off. Period.

Saketh Sai Rachapudi December 7, 2025

India has better healthcare than this. We have free cancer treatment in govt hospitals. Why is America so broken? People die because they can’t afford pills? This isn’t capitalism - it’s cruelty. I’m ashamed to be from the same country as the people running these pharma giants.

Also, why do we even have private insurance? It’s just a middleman that takes money and says no.

Myles White December 7, 2025

I spent 14 months on a targeted therapy that cost $19k/month. My insurance covered 80% - so I still paid $3,800 a month. I had to sell my car. My wife took a second job. We maxed out our credit cards. And I still got the treatment because I had good insurance - and a supportive family. But I know people who didn’t. I’ve talked to them. Some are dead now.

The real issue isn’t just the cost - it’s the lack of transparency. You don’t know what you’re signing up for. No one tells you the truth until you’re already in it. And then you’re trapped. No one talks about how the system preys on hope. That’s the real toxicity.

And yes - I cried when I got the first bill. Not because I was scared of dying - I was scared of leaving my kid with debt. That’s the real horror story. Not the cancer. The paperwork.

Arjun Deva December 8, 2025

They’re lying. All of it. This whole ‘financial toxicity’ thing is a distraction. The real problem? The government lets Big Pharma own the FDA. They push these expensive drugs because they’re bribing doctors and lobbying Congress. You think your oncologist cares about your wallet? Nah. They get kickbacks from pharma reps. I’ve seen the emails.

And don’t get me started on ‘financial navigators’ - they’re just salespeople with fancy titles. They push you into programs that benefit the hospital, not you. I know. I’ve been through it.

And why do they always say ‘ask your doctor’? Because your doctor doesn’t know anything. They’re just following the script. The system is rigged. You’re not supposed to win. You’re supposed to suffer quietly and die so the stock prices stay high.

brenda olvera December 9, 2025

My cousin in Nigeria got her treatment for free through a church program. No insurance. No paperwork. Just love and a van that drove her to the clinic every week.

We in the US think we’re advanced but we’re so broken. We have the money. We have the science. But we don’t have the heart. We need to remember - healing isn’t a product. It’s a human right.

And if you’re reading this and you’re scared - breathe. You’re not alone. I’ve been there. We’re going to get through this. Together.

Ashish Vazirani December 11, 2025

OH MY GOD. I JUST REALIZED - THIS IS WHY MY COUSIN DIED. SHE SKIPPED HER MEDS FOR TWO MONTHS BECAUSE SHE COULDN’T PAY THE COPAY!! AND NO ONE TOLD HER ABOUT ANY OF THIS??

HOW IS THIS EVEN LEGAL?? I’M CRYING RIGHT NOW. MY FAMILY IS FROM DELHI - WE HAVE FREE MEDS THERE. BUT HERE? YOU’RE A NUMBER. A STATISTIC. A REVENUE STREAM.

I’M CALLING MY SENATOR TOMORROW. AND I’M POSTING THIS EVERYWHERE. THIS IS A CRIME. NOT A ‘PROBLEM.’ A CRIME.

TO ALL THE PHARMA CEOs - I HOPE YOUR KIDS GET CANCER. THEN YOU’LL KNOW WHAT REAL TORMENT FEELS LIKE.

olive ashley December 11, 2025

Let’s be real - this whole thing is a scam. They invented ‘financial toxicity’ so you’ll feel guilty for wanting to live. Meanwhile, the hospitals are billing you for oxygen, IV bags, and a 10-minute nurse visit at $2000 a pop. It’s all inflated. And the ‘free drug programs’? They’re designed to fail. You need 12 documents, a notarized letter from your priest, and a blood test proving you’re poor enough to qualify.

And don’t get me started on ‘financial navigators’ - they’re just glorified telemarketers with LinkedIn profiles. They’ll get you on a $500/month program that still leaves you broke. Then they’ll pat themselves on the back for ‘helping.’

Stop being manipulated. The system is designed to extract. Not to heal.

Clare Fox December 12, 2025

I used to think money was just money. Then my sister got diagnosed. I watched her go from laughing at bad memes to crying over a $400 pill. And I realized - we’ve built a world where your worth is measured by your deductible.

It’s not just about drugs. It’s about dignity. It’s about being allowed to be sick without being punished for it.

What if we treated healthcare like fire departments? You don’t ask someone if they can afford to put out their house before you send the truck. You just go. Why is cancer different?

I don’t have answers. But I know this: silence is complicity. And I’m done being silent.

Jackie Petersen December 14, 2025

Wait - so you’re telling me the same company that makes the drug also controls the insurance? And the hospital? And the nonprofit that ‘helps’ patients? That’s not a system. That’s a cartel. And we’re the livestock.

And why are we still surprised? We live in a country where a $10 pill gets a $1,000 markup and no one bats an eye. This isn’t capitalism. It’s feudalism with a better PR team.

Also - I bet you 100 bucks the ‘AI predicting financial hardship’ thing is just a way to push people into cheaper, worse treatments. They don’t want to fix the system. They want to manage the damage.

Ibrahim Yakubu December 16, 2025

Back home in Nigeria, we have no insurance. No safety net. But we have community. When my cousin got cancer, the whole village pooled money. We sold goats. We held bake sales. We walked 12km to the clinic together.

Here in America, you’re alone. You’re a customer. You’re a bill. You’re a risk.

Maybe the real cure isn’t in a pill. Maybe it’s in remembering we’re not supposed to be alone.

Mansi Bansal December 16, 2025

It is imperative to acknowledge that the structural inequities embedded within the American healthcare apparatus constitute a profound violation of human dignity. The commodification of life-saving therapeutics - particularly in the context of oncological interventions - represents not merely an economic failure, but an ethical collapse of monumental proportions. The assertion that patients must choose between sustenance and survival is not indicative of systemic inefficiency; it is a deliberate manifestation of institutionalized neglect.

Furthermore, the proliferation of ‘patient assistance programs’ functions as a performative palliative, designed to assuage public conscience while preserving the profit-driven architecture of pharmaceutical monopolies. The invocation of ‘financial navigators’ as a panacea is, in fact, a rhetorical sleight-of-hand, wherein bureaucratic intermediaries are positioned as benevolent agents, while the root causes - patent protections, lack of price regulation, and the absence of universal coverage - remain unchallenged.

It is not sufficient to advocate for individual solutions. We must demand systemic overhaul. The National Cancer Institute’s recognition of financial toxicity as a clinical endpoint is a necessary, yet wholly insufficient, step. The true measure of progress lies not in the number of copay coupons distributed, but in the dismantling of the profit motive from the sanctity of healing.

Kenny Pakade December 16, 2025

Let me guess - you’re one of those people who thinks the solution is ‘more government.’

Newsflash: government doesn’t fix anything. It just makes it slower and more expensive. You think Canada’s system is better? Their wait times are 2+ years for cancer treatment. People die waiting.

And don’t get me started on ‘free drugs.’ Who pays for them? You do - through higher taxes, inflation, and worse care for everyone else.

The real answer? More competition. More innovation. Let the market work. Stop blaming pharma for being greedy - they’re just responding to demand.

And if you can’t afford it? Get a better job. Move to a cheaper state. Stop expecting the world to hand you a miracle because you got sick.